Nonfarm payroll employment continued to decline in July (-247,000),

and the unemployment rate was little changed at 9.4 percent, the U.S.

Bureau of Labor Statistics reported today. The average monthly job

loss for May through July (-331,000) was about half the average

decline for November through April (-645,000). In July, job losses

continued in many of the major industry sectors.

The change in total nonfarm payroll employment for May was revised

from -322,000 to -303,000, and the change for June was revised from -

467,000 to -443,000.

Subscribe to EF Hutton via Email

THE EMPLOYMENT SITUATION -- JULY 2009

Nonfarm payroll employment continued to decline in July (-247,000),

and the unemployment rate was little changed at 9.4 percent, the U.S.

Bureau of Labor Statistics reported today. The average monthly job

loss for May through July (-331,000) was about half the average

decline for November through April (-645,000). In July, job losses

continued in many of the major industry sectors.

Household Survey Data

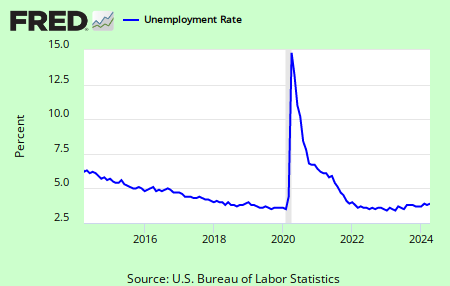

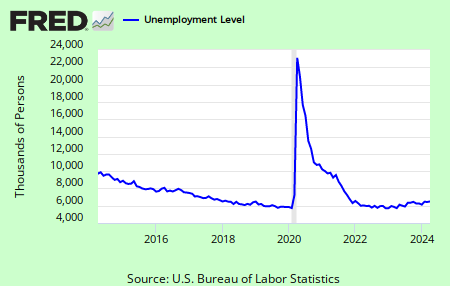

In July, the number of unemployed persons was 14.5 million. The

unemployment rate was 9.4 percent, little changed for the second

consecutive month. (See table A-1.)

Among the major worker groups, unemployment rates for adult men (9.8

percent), adult women (7.5 percent), teenagers (23.8 percent), whites

(8.6 percent), blacks (14.5 percent), and Hispanics (12.3 percent)

were little changed in July. The unemployment rate for Asians was 8.3

percent, not seasonally adjusted. (See tables A-1, A-2, and A-3.)

The number of long-term unemployed (those jobless for 27 weeks or more)

rose by 584,000 over the month to 5.0 million. In July, 1 in 3 unemploy-

ed persons were jobless for 27 weeks or more. (See table A-9.)

The civilian labor force participation rate declined by 0.2 percentage

point in July to 65.5 percent. The employment-population ratio, at 59.4

percent, was little changed over the month but has declined by 3.3 per-

centage points since the recession began in December 2007. (See

table A-1.)

The number of persons working part time for economic reasons (sometimes

referred to as involuntary part-time workers) was little changed in July

at 8.8 million. The number of such workers rose sharply in the fall and

winter but has been little changed for 4 consecutive months.

(See table A-5.)

About 2.3 million persons were marginally attached to the labor force

in July, 709,000 more than a year earlier. (The data are not seasonally

adjusted.) These individuals, who were not in the labor force, wanted

and were available for work and had looked for a job sometime in the

prior 12 months. They were not counted as unemployed because they had

not searched for work in the 4 weeks preceding the survey. (See

table A-13.)

Among the marginally attached, there were 796,000 discouraged workers

in July, up by 335,000 over the past 12 months. (The data are not

seasonally adjusted.) Discouraged workers are persons not currently

looking for work because they believe no jobs are available for them.

The other 1.5 million persons marginally attached to the labor force

in July had not searched for work in the 4 weeks preceding the survey

for reasons such as school attendance or family responsibilities.

Establishment Survey Data

Total nonfarm payroll employment declined by 247,000 in July. From May

to July, job losses averaged 331,000 per month, compared with losses

averaging 645,000 per month from November to April. Since December

2007, payroll employment has fallen by 6.7 million. (See table B-1.)

Employment in construction declined by 76,000 in July, about in line

with the average for the past 3 months (-73,000). Employment had de-

creased by 117,000 a month on average from November to April.

Manufacturing employment fell by 52,000 in July and has declined by

2.0 million since the recession began. In motor vehicles and parts,

fewer workers than usual were laid off in July for seasonal retool-

ing. As a result, the estimate of employment for the industry rose

by 28,000 after seasonal adjustment. In large part, July's seasonally-

adjusted increase reflects the fact that previous job cuts had been

so extensive that there were fewer workers to lay off during the sea-

sonal shutdown. Elsewhere in manufacturing, several industries con-

tinued to lose jobs in July, including machinery (-15,000) and fabri-

cated metal products (-14,000).

In July, retail trade employment declined by 44,000. Job losses in the

industry had averaged 27,000 per month over the prior 3 months. Em-

ployment in wholesale trade fell by 19,000 in July, with the majority

of the decline occurring among durable goods wholesalers.

Employment in professional and business services continued to trend

down in July (-38,000); the industry has shed 1.5 million jobs since

the start of the recession. Within professional and business services,

employment in the temporary help industry edged down in July. While

temporary help has lost 844,000 jobs since the recession began, the

declines have lessened substantially over the past 3 months.

Transportation and warehousing lost 22,000 jobs in July. Since May,

the average monthly job loss was half the average monthly decline for

November through April (-17,000 versus -34,000).

Financial activities employment continued to trend down in July

(-13,000). The average monthly decline for this industry was 23,000

over the past 3 months compared with 46,000 per month from November

through April. Since the start of the recession, the financial acti-

vities industry has lost 501,000 jobs. Employment in information de-

clined by 16,000 in July, including losses in publishing and telecom-

munications.

Health care employment increased by 20,000 in July, about in line

with the average monthly gain for the first half of this year but

down from an average monthly increase of 30,000 during 2008. Employ-

ment in lei-sure and hospitality has been little changed over the

past 3 months.

In July, the average workweek of production and nonsupervisory work-

ers on private nonfarm payrolls edged up by 0.1 hour to 33.1 hours.

The manufacturing workweek increased by 0.3 hour to 39.8 hours. Fac-

tory overtime was unchanged at 2.9 hours. (See table B-2.)

In July, average hourly earnings of production and nonsupervisory

workers on private nonfarm payrolls rose by 3 cents, or 0.2 percent,

to $18.56. Over the past 12 months, average hourly earnings have

increased by 2.5 percent, while average weekly earnings have risen

by only 1.0 percent due to declines in the average workweek. (See

table B-3.)

The change in total nonfarm payroll employment for May was revised

from -322,000 to -303,000, and the change for June was revised from -

467,000 to -443,000.

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow E F Hutton on Twitter

Kindle: Amazon's 6"  Wireless Reading Device

Wireless Reading Device