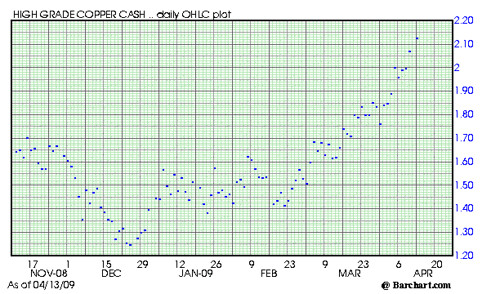

There is saying in copper -- buy on Thanksgiving, sell on Easter. Worked pretty good this year. Although, it was a little hair raising from Thanksgiving to the December low.

China has also been a big buyer of metals like aluminum, nickel, zinc, and tin.

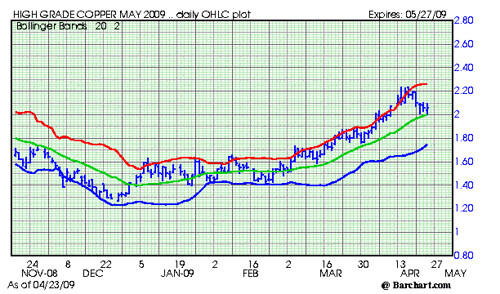

Chart Notes:

- Copper was overbought at the rally highs.

- Copper traded above the red line (two standard deviations above the mean) and was due for a correction.

- The market is currently testing the green line and 2.00.

- The trend is up and the short, intermediate, and long term averages are all pointing up.

- First support is around 2.00 and major support is in a band from 1.80 to 1.90.

- Resistance is at the current highs around 2.23.

- Technicals point to higher prices.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

More from All American Investor

- 30 Year Conventional Mortgage Rate (Chart)

- Top Hedge Fund Managers Make Billions in 2008

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Option ARM--The Toxic Mortgage

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)

Follow All American Investor on Twitter