I decided to use the weekly chart so you can get a better long term perspective.

The daily GSCI chart broke out to the upside on a close over 380. The weekly chart is now breaking out with a close over 400. Next upside target is 460. This might not seem like much, but it is 15 percent. The GSCI is currently over bought so there could be some chopping around before we head sharply higher.

I have been posting the charts on money supply, the FED balance sheet, and reserves for months. They all look like a gushing oil well. I wrote some time ago that it usually takes 12-18 months for these effects to bring inflation. We are now inside those windows.

I am also following long term interest rates. The Fed was in buying size and this caused a short term back up in prices. This will be a short term phenomena. A real battle is brewing between the FED and the bond vigilantes. The FED has used about 30 percent of their announced bullets already.

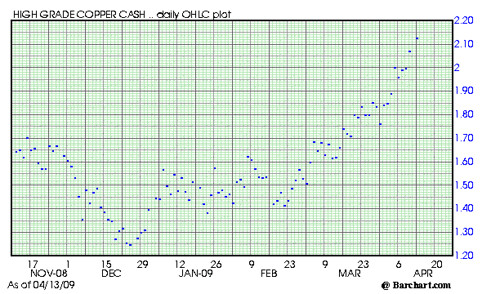

Expect commodity prices to trend higher over the next several years.

A good look at the GSCI chart shows a 2008 high near 900 on the upside. Since the GSCI is heavily weighted in oil, it is likely that a long list of commodities will make new highs before oil.

Subscribe to EF Hutton via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow E F Hutton on Twitter