There is a saying in technical trading that the fourth time up is the charm.

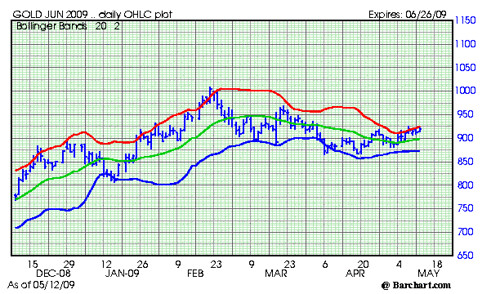

As you can see by looking at the Gold Chart, this is the fourth time up.

I am a little surprised by the rise in Gold at this time of year.

- The more normal seasonal pattern is for Gold to peak in February - March.

- After the seasonal peak, Gold normally trades down into the August - October period.

- The strongest trading period for Gold normally occurs from October into March.

- The seasonal pattern tells me that Gold is likely to take a rest.

- On the other hand, the market looks very strong, technically, right now.

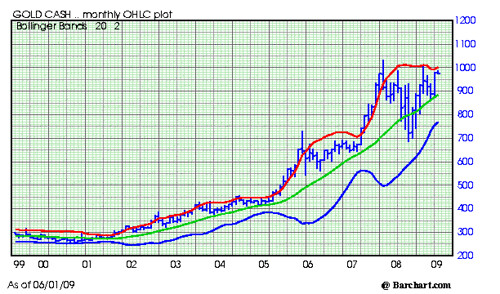

A close in Gold over 1,067.50 is likely to lead to an explosive up leg in gold. I am expecting this to happen, and the rise could very well be much higher than is currently being forecast by most.

I wrote previously about how I expect the buying of Gold out of Hong Kong to be enormous once the bull leg gets underway.

Back in the bull market of 1978 - 1980, Gold was often up sharply at the U.S. open based on large buying out of Hong Kong. Buying power from the China mainland should be a major factor in the price of gold in the year ahead. The buying is already picking up some momentum.

My experience tells me Gold is due for another correction back toward the 925 area -- the typical seasonal pattern. On the other hand, a break above this existing top could lead to a monster rally.

Long term gold traders should be patient and let it happen. Buyers of Gold stocks should see gains like they have rarely seen in the year ahead.

More from All American Investor

Kindle: Amazon's Wireless Reading Device (Latest Generation)

My experience tells me Gold is due for another correction back toward the 925 area -- the typical seasonal pattern. On the other hand, a break above this existing top could lead to a monster rally.

Long term gold traders should be patient and let it happen. Buyers of Gold stocks should see gains like they have rarely seen in the year ahead.

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

More from All American Investor

- Top Hedge Fund Managers Make Billions in 2008

- Systemic Risk Defined--Too Big to Fail

- Ray Dalio on the current state of affairs in the market

- Roubini Predicts U.S. Losses May Reach $3.6 Trillion

- Option ARM--The Toxic Mortgage

- Warren Buffett's Annual Letter to Investors (Cliff Notes Version)