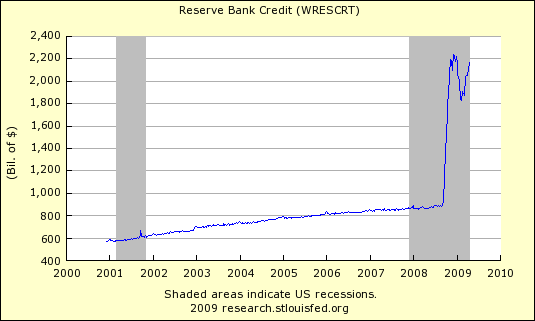

The Federal Reserve is starting to expand their balance sheet again. Week over Week.

- The biggest increase this week is in the purchase of Mortgage Backed Securities (MBS) -- up $75 Billion.

- An additional $18 Billion increase in Maiden Lane LLC (Bear Stearns bailout).

- An additional $ 34 Billion increase in Maiden Lane II LLC and Maiden Lane III LLC (AIG bailout).

- U.S. Treasury securities held outright rose $94 Billion, and $405 Billion versus a year ago.

- Reserve Bank Credit rose $70 Billion week, and $1.3 Trillion versus a year ago.

- Reserve Bank Credit now stands at $2.169 Trillion and is once again approaching the peak of $2.31 Trillion (December, 2008).

Notes: H.4.1 Reserve Bank credit is the sum of securities held outright, repurchase agreements, term auction credit, other loans, net portfolio holdings of Commercial Paper Funding Facility LLC, net portfolio holdings of LLCs funded through the Money Market Investor Funding Facility, net portfolio holdings of Maiden Lane LLC, net portfolio holdings of Maiden Lane II LLC, net portfolio holdings of Maiden Lane III LLC, float, central bank liquidity swaps, and other Federal Reserve assets

Subscribe to All American Investor via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |

Follow All American Investor on Twitter