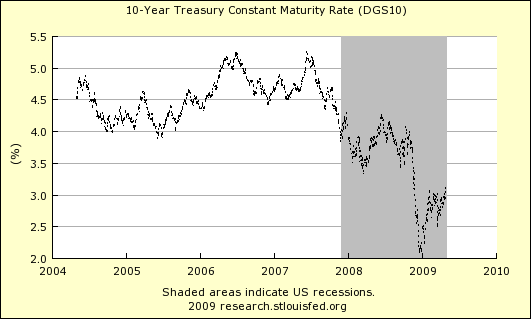

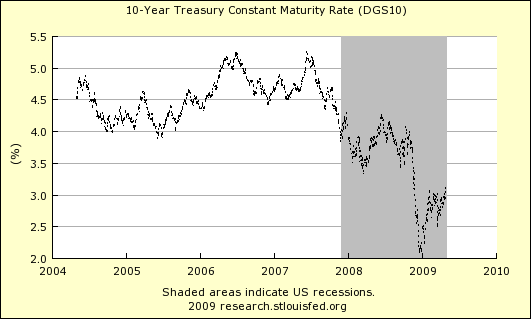

For several weeks, I have been writing about longer dated Treasury securities and the importance of paying attention to interest rates if you are an investor.

The ten year Treasury interest rate is moving up fast. This week it challenged and broke the important 3.125 area. At the same time, the FOMC reaffirmed its intention of buying treasury securities in size.

Federal Reserve will buy up to $300 billion of Treasury securities by autumn.

The Fed can hold down short term interest rates until inflation picks up. However, the Fed cannot hold down long term interest.

I also posted charts showing the growth of the Fed's balance sheet and the explosive growth in money supply.

The bond vigilantes are coming back. Soon this will be the talk of the town. And, discussion about inflation and risk premiums will bring new jitters into the stock market.

You heard it here first.

The bond vigilantes are coming back. Soon this will be the talk of the town. And, discussion about inflation and risk premiums will bring new jitters into the stock market.

You heard it here first.

Subscribe to EF Hutton via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Bob has written more than 500 articles with more than 11,000 links to his work on the Internet. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |