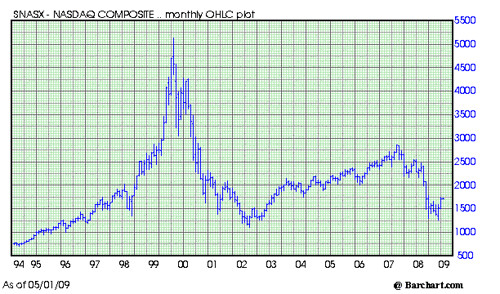

Sometimes it is helpful to look at the market from a long term perspective. I think most believe the current bear market is new. However, the long term view indicates we have been in a bear market since the Nasdaq Composite topped out at 5,132 in March, 2000.

The high for the Nasdaq Composite in 1997 was 1690, then an all time high. You could say we are going no where fast.

Are we now in a long period of consolidation, prior to a new big bull?

Or, is the market consolidating before re-testing the October, 2002 near 1108?

I think the important perspective here is simple. This is a good time to be buying stocks on breaks to the downside. If you are young enough and investing for retirement, this might be the opportunity of a lifetime.

Baby Boomer? Ouch!

Subscribe to EF Hutton via Email

Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. Bob DeMarco is a citizen journalist and twenty year Wall Street veteran. Content from All American Investor has been syndicated on Reuters, the Wall Street Journal, Fox News, Pluck, Blog Critics, and a growing list of newspaper websites. Bob is actively seeking syndication and writing assignments. |